Quick Summary: Why This Funnel Works

- Personalized Experience: The funnel starts with a simple quiz that helps tailor credit card recommendations based on the user’s specific circumstances, such as their credit score and preferences, creating a more relevant and engaging experience.

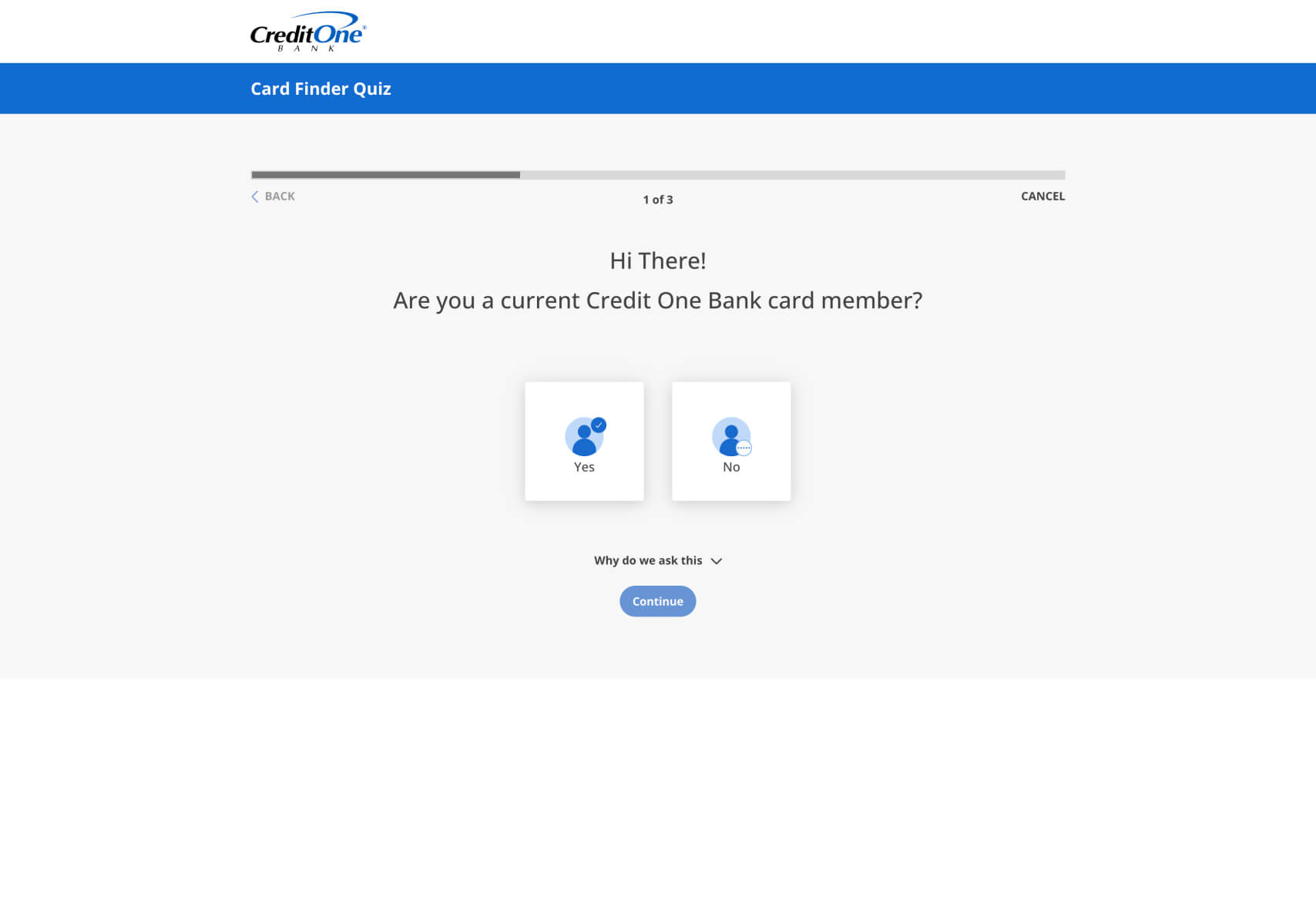

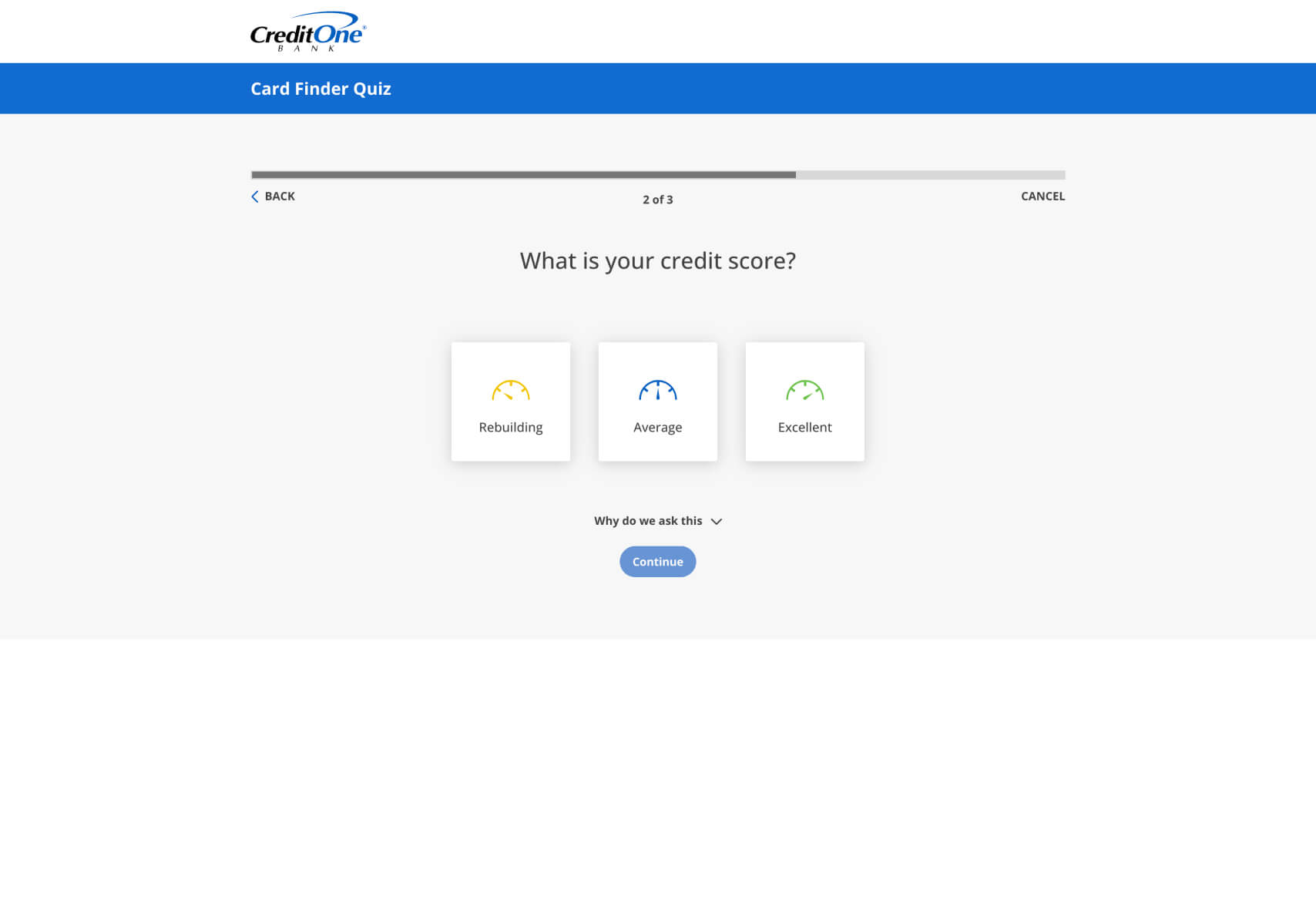

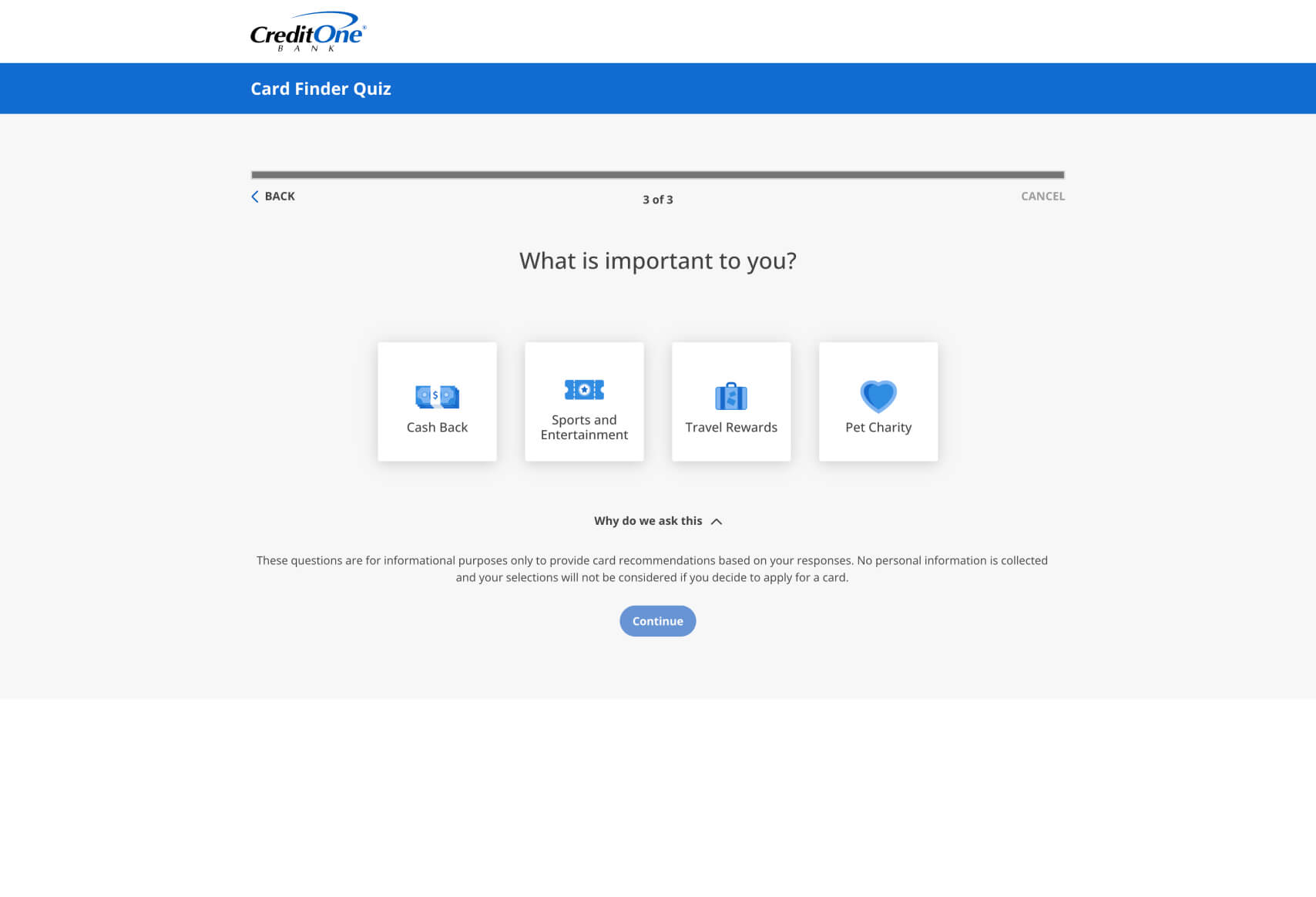

- User-Friendly Design: The interface is clean and minimalistic, with large, easily clickable buttons that ensure users can quickly navigate through the quiz without confusion or frustration.

- Progress Indicator: A visible progress bar at the top of each screen provides users with a sense of where they are in the process, encouraging them to complete the quiz by showing that it won’t take long.

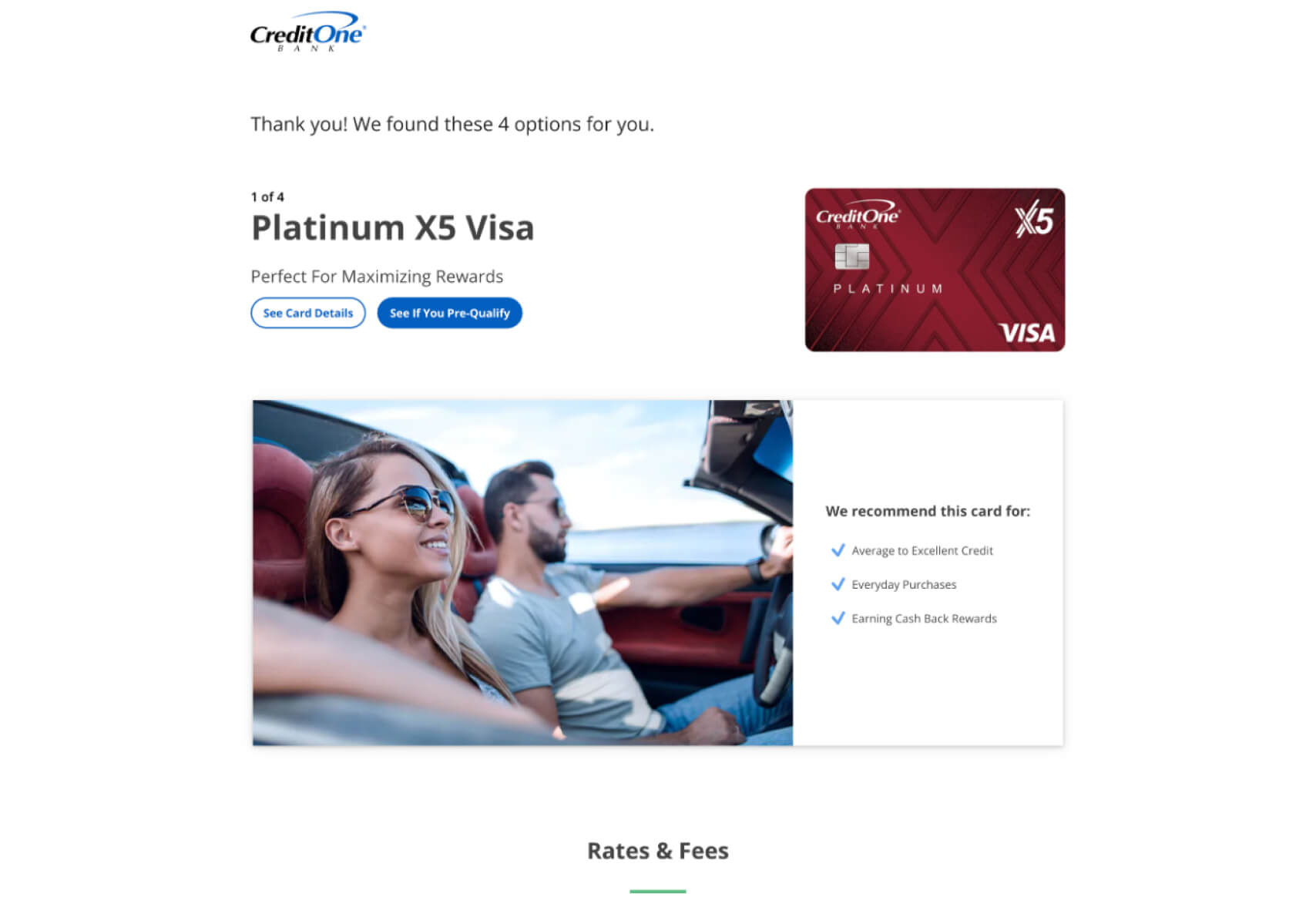

- Clear Call to Action: The final screen clearly presents the recommended credit cards, with options to “See Card Details” or “See If You Pre-Qualify,” making the next steps for the user obvious and actionable.

- Engaging Language: The use of friendly language such as “Hi There!” and simple questions make the quiz feel more conversational and less like a formal process, which can reduce user anxiety and increase completion rates.

Why This Business Might Have Chosen This Funnel

Credit One Bank has likely implemented this quiz-style funnel for a few strategic reasons:

- Increased Engagement: The interactive nature of a quiz can be more engaging than a traditional form. Users might find it more enjoyable and less tedious to answer a series of questions that feel relevant to their personal situation, rather than filling out a static application form.

- Lead Qualification: By asking key questions such as “What is your credit score?” and “What is important to you?” the funnel helps Credit One Bank pre-qualify leads. This ensures that only the most relevant credit card options are shown to users, increasing the likelihood of conversion.

- Data Collection for Personalization: The funnel allows Credit One Bank to gather valuable information about potential customers, which can be used to tailor marketing efforts and product recommendations more effectively in the future. The data collected also helps in crafting personalized offers that resonate more with users, enhancing the user experience and driving loyalty.

- Reduced Friction: The step-by-step approach, combined with clear and simple questions, reduces friction for users. This helps to lower abandonment rates as users are less likely to feel overwhelmed by the process.

- Trust and Transparency: The quiz includes explanations like “Why do we ask this?” which provide transparency about why certain information is requested. This transparency helps build trust with users, which is especially important in the financial services industry.

Impactful Questions in Credit One’s Funnel

1. “Are you a current Credit One Bank card member?”

- Tailoring the Experience: This initial question immediately segments users, allowing the funnel to customize the next steps based on whether the user is already a customer or a new prospect. It helps in providing relevant offers, which can be more appealing to the user.

2. “What is your credit score?”

- Relevant Offer Matching: By asking this question, Credit One Bank can match users with credit card options that best suit their financial situation, increasing the likelihood of application approval and user satisfaction.

3. “What is important to you?”

- Prioritizing User Needs: This question allows users to express what benefits they value most in a credit card (e.g., cash back, travel rewards). It helps Credit One Bank recommend the most suitable cards, thereby enhancing the personalization and relevance of the offers.

This Product Recommendation Funnel effectively guides users through a quick, engaging process to help them find the most suitable credit card based on their individual preferences and credit profile. This approach not only enhances customer engagement but also likely leads to improved conversion rates. For more examples of similar funnels, you can explore our listings page.

No development or design required

No development or design required  Executed by just adding one line of Convincely code to your website

Executed by just adding one line of Convincely code to your website  Plan and strategize with your team. Execute and deploy with Convincely

Plan and strategize with your team. Execute and deploy with Convincely